Cellecor Gadgets’ (NSE:CELLECOR) Earnings May Be Down Under

Investors were disappointed Description of Cellecor Gadgets Limited shares (NSE:CELLECOR) earnings, despite strong profit numbers. We think the market can pay attention to other fundamentals that they see as relevant.

Check out our latest review for Cellecor Gadgets

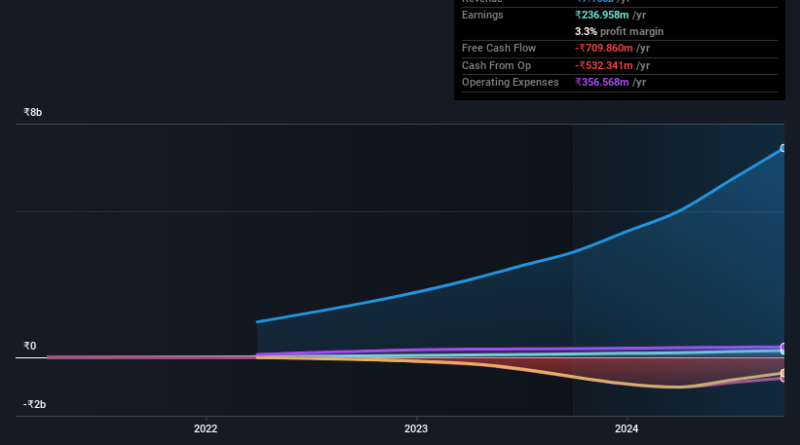

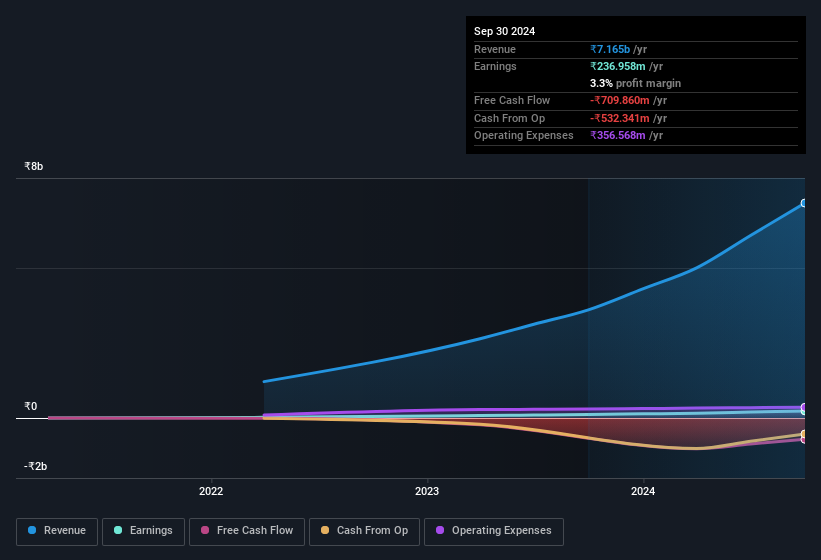

Analyzing Cash Flow vs. Earnings for Cellecor Gadgets

Another important financial ratio used to measure how well a company converts its profits to free cash flow (FCF) is accrual ratio. To find the accrual rate we first subtract the FCF from the profit for a period, then divide that number by the total operating assets for the period. The ratio tells us how much a company’s profit exceeds its FCF.

Therefore, it is actually considered a good thing when a company has a bad ratio, but it is a bad thing if its ratio is good. While it is not a problem to have a good accrual ratio, which indicates a certain level of non-cash profit, a high accrual ratio is a bad thing, because it indicates that the paper’s profit is not consistent and cash flow. To quote a 2014 paper by Lewellen and Resutek, “firms with high liquidity tend to be less profitable in the future”.

For the twelve months to September 2024, Cellecor Gadgets reported a ratio of 0.74. Generally, that bodes poorly for future profits. Of course, at that time the company was not generating free cash flow. The last twelve months have had it bad free cash flow, with an outflow of ₹710m despite a profit of ₹237.0m, mentioned above. We also note that Cellecor Gadgets’ free cash flow was really bad last year, so we could understand why shareholders are worried about its ₹710m exit.

Note: we always encourage investors to check the strength of the page. Click here to be taken to our Cellecor Gadgets benchmark review.

Our Cellecor Gadgets Profit Process

As we discussed above, we think Cellecor Gadgets’ earnings were not supported by free cash flow, which may affect some investors. As a result, we think that the earnings power of Cellecor Gadgets is likely to be lower than its statutory profit. But on the bright side, its earnings per share have grown at a very impressive rate over the past three years. Of course, we have just signed up when it comes to analyzing its earnings; one can also consider margins, expected growth, and return on investment, among other factors. If you want to know more about Cellecor Gadgets as a business, it is important to be aware of any risks it faces. Example: We saw 3 warning signs for Cellecor Gadgets you should be aware.

This letter focuses on just one aspect that provides insight into the nature of Cellecor Gadgets’ profitability. But there is much more to gain if you can focus your mind on the minutiae. For example, many people take a high return on equity as a sign of good business economics, while others like to ‘follow the money’ and look for stocks that insiders buy. So you might want to see this for free a collection of companies that boast a high return on equity, or this list of stocks with high ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide opinions based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#Cellecor #Gadgets #NSECELLECOR #Earnings